If you’re asking me, “how much does it cost to become a real estate agent?” well, you’re...

Blog

Know the Difference for Real Estate Pros The real estate industry is full of titles that sound...

Author – Joe Stephenson, REALTOR® Believe me when I say that a single good REALTOR® review can...

Author – Joe Stephenson, REALTOR® I think a great listing presentation script can significantly increase your success...

Author – Joe Stephenson, REALTOR® I think that kicking off a listing appointment with a rock-solid pre...

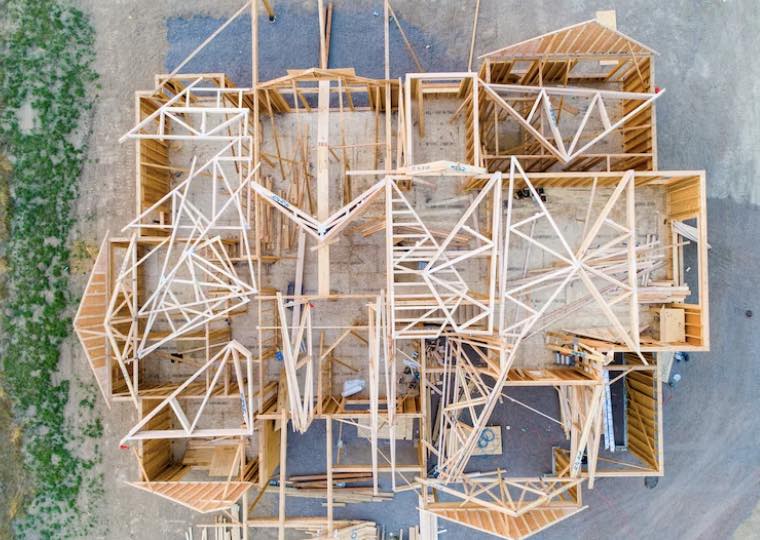

Author – Joe Stephenson, REALTOR® I believe that accurately estimating land value is one of the most...

Author – Joe Stephenson, REALTOR® When I host an open house, I know how every small detail...

Author – Joe Stephenson, REALTOR® There are many steps to this process. I recall my first time....

My Expert Chat With Joe Stephenson Buy → Rehab → Rent → Refinance → Repeat: the real-estate...

Author – Joe Stephenson, REALTOR® I vividly remember the first time I encountered the term SFR. I...