REAL ESTATE AGENT / METHODS

By: Joe Stephenson REALTOR®

- Introduction

- The Sales Comparison Approach

- The Cost Approach

- The Income Approach

- Gross Rent and Gross Multipliers Approach

- What is a Comparative Market Analysis?

- Contact

Throughout my career as a real estate agent, I’ve seen firsthand how crucial it is to know how to find the value of a house.An accurate home value estimate can mean the difference between setting a competitive listing price and missing out on potential buyers.

It influences how appealing a property is in today’s market and can even impact your property taxes. Knowing a its place within real property and determining the home’s fair market value is essential for making informed choices with a willing seller.

Over the years, I’ve relied on tools like a home value estimator tool and kept a close watch on buyer demand to help homeowners assess their property’s worth effectively. There are several methods I recommend when it comes to evaluating your home’s value.

Method 1). The Sales Comparison Approach

The sales comparison approach is a popular method for estimating a home’s value, relying on neighborhood comps and available data to provide an accurate assessment.

It considers many factors, such as the home’s usable space, location, and home improvements, to determine how it compares to similar properties recently sold on the open market. An estimator home tool, often employed in this process, is updated regularly to reflect current market conditions.

Step 1 – Collect Data on Comparable Properties

Gather data on comparable homes in your area. Look for homes with similar square footage, number of bedrooms and bathrooms, and proximity to amenities like schools and shopping centers.

Step 2 – Make Adjustments to Comparables

Make adjustments based on distinctive features. For example, if your home has a renovated kitchen or a larger yard than the comparables, its estimated value may be higher.

This method is effective for most residential properties and gives an accurate valuation based on local market conditions. You can use online home valuation tools or ask a real estate professional for a comparative market analysis.

It serves a particular purpose by offering a reliable value estimated based on comparable homes, making it an effective way to gauge a property’s worth.

How to Make Adjustments

Adjustments are changes made to the sale prices of comparable properties to account for differences between these properties and the subject property.

The goal is to estimate what the sale price of each comparable would have been if it were identical to the subject property.

Here are some key factors that may require adjustments:

Adjustment Rules

Adjustment rules guide how changes should be made to each comparable’s sale price.

These rules consider the impact of various factors on home values, including the terms or conditions of sale, the date of sale, location, physical condition and features, and gross living area and room count.

Terms or Conditions of Sale

The terms or conditions of sale can significantly affect a property’s sale price.

For example, if a buyer paid cash for a property, the sale price might have been lower than if financing was involved.

In such cases, an adjustment may be necessary to reflect the impact of these terms on the sale price.

Date of Sale

The housing market fluctuates over time. Thus, the date of sale is an important factor to consider when making adjustments.

If a comparable property was sold several months ago, its sale price may not reflect current market trends.

An adjustment can bring the sale price in line with the current value.

Location

Location is another crucial factor that influences property values.

Two houses may be identical, but if one is located in a desirable neighborhood while the other is not, their values will differ.

Adjustments for location take into account factors like proximity to amenities, quality of schools, crime rates, and noise levels.

Physical Condition and Features

The physical condition of a property and its unique features can also affect its value.

For example, a home with a new roof or a renovated kitchen will likely have a higher value than a comparable property without these features.

Adjustments for physical condition and features consider these differences.

Gross Living Area and Room Count

The size of a house, typically measured by its gross living area, and the number of rooms it has can significantly influence its value.

Adjustments may be necessary if the subject property has more or fewer rooms or a larger or smaller living area than the comparables.

Example

Let’s say a real estate agent is trying to determine the market value of a 3-bedroom house with a renovated kitchen, located in a desirable neighborhood. The agent finds three comparable properties.

- A 3-bedroom house sold for $300,000 six months ago, with an outdated kitchen and in a less desirable neighborhood.

- A 4-bedroom house sold for $350,000 three months ago, with a renovated kitchen and in the same neighborhood.

- A 3-bedroom house sold for $320,000 one month ago, with an outdated kitchen but in a desirable neighborhood.

The agent would make adjustments to the sale prices of these comparables based on the differences in kitchen renovations, location, and date of sale.

Setting a Dollar Amount of Adjustments

To set a dollar amount for each adjustment, the real estate agent might consult local market trends, professional appraiser guidelines, or use their judgment based on experience.

For instance, the agent might add $20,000 to the sale price of the first comparable for its outdated kitchen and less desirable location.

They might subtract $50,000 from the second comparable for the extra bedroom. And they might add $10,000 to the third comparable for its outdated kitchen.

Finding the Adjusted Sales Price

After making these adjustments, the agent would have the adjusted sale prices of the comparables.

They could then average these prices to estimate the fair market value of the subject property. This process helps provide a more accurate representation of a home’s value, which can be beneficial for both sellers and interested buyers.

Making adjustments is a crucial step in the Sales Comparison Approach to home valuation. It ensures that the estimated value of your home reflects its true value in the context of the local housing market.

Remember, assessed value and appraised value are different but both are important when considering home values. Always consult with a professional to get the most accurate estimate.

Comparative Sales Approach Diagram Table

| Property Feature | Subject Property | Comparable #1 $242,000 | Comparable #2 $252,000 | Comparable #3 $248,500 |

|---|---|---|---|---|

| Sales price | $248,000 | Current $0 | Current $0 | Current $0 |

| Age | 10 years | 15 yrs. $3,000 | 20 yrs. $5,000 | 5 yrs. $0 ($1,000) |

| Location | Good | Poorer $4,000 | Better ($4,000) | Same $0 |

| Lot size | 80’x125′ | 40’x125′ $5,000 | 60’x125′ $3,000 | 80’x200′ ($1,000) |

| Landscaping | Good | Better ($2,000) | Same $0 | Poorer $2,000 |

| Number of rooms | 6 | 7 ($5,000) | 6 $0 | 5 $7,000 |

| Bedrooms | 3 | 4 ($10,000) | 3 $0 | 2 $15,000 |

| Baths | 2 | 3 ($12,000) | 2 $0 | 1 $20,000 |

| Sq. Ft. of living space | 1800 sq. ft. | 2100 sq. ft. ($15,000) | 2000 sq. ft. ($10,000) | 1700 sq. ft. $2,000 |

| Basement type | Full, partially finished | Full, unfinished $5,000 | Full, finished ($7,000) | None $25,000 |

| Garage size | 2-car | 1-car $8,000 | 2-car $0 | None $15,000 |

| Exterior condition | Good | Excellent ($3,000) | Good $0 | Fair $5,000 |

| Interior condition | Good | Excellent ($4,000) | Good $0 | Fair $6,000 |

| Style | Ranch | Colonial $5,000 | Contemporary $7,000 | Split-level $6,000 |

| Construction | Brick | Vinyl siding $4,000 | Stone $6,000 | Wood siding $3,000 |

| Other improvements | None | New roof ($5,000) | Updated kitchen and baths ($10,000) | Updated kitchen $0 |

| Adjusted Sales Price | $248,000 | $240,000 | $252,000 | $275,000 |

Free Download of this Template

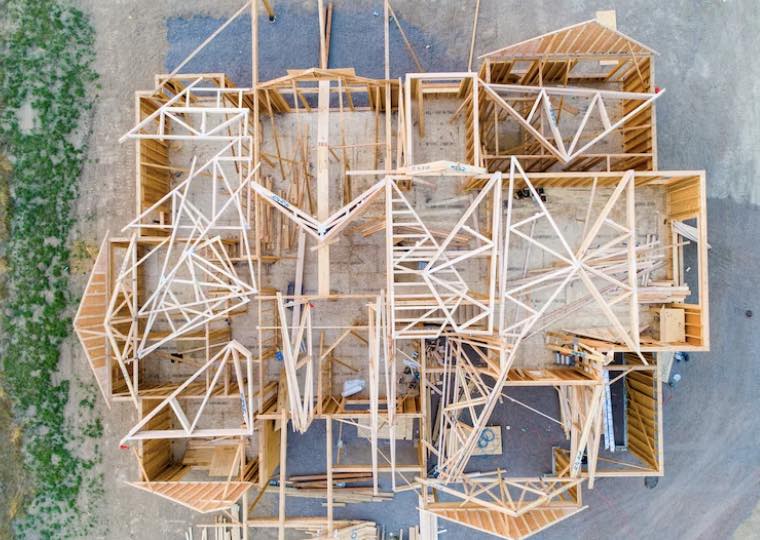

Method 2). The Cost Approach

The Cost Approach is often used for new or unique properties, where there are not enough comparable properties for the Sales Comparison Approach. This method estimates how much it would cost to rebuild the property from scratch.

Step 1 – Estimate Current Cost of Construction Improvements

First, estimate the cost of constructing the house’s improvements—everything from the foundation to the roof. You can consult construction companies or use data from the Federal Housing Finance Agency.

Step 2 – Estimate Accrued Depreciation

Next, estimate the home’s accrued depreciation, which includes physical wear and tear, functional obsolescence (outdated design features), and economic obsolescence (external factors like a declining neighborhood).

Step 3 – Deduct Depreciation from Construction Costs

Subtract the estimated depreciation from the construction costs. This gives you the depreciated cost of improvements.

Step 4 – Add the Land Value

Finally, add the value of the land, which you can get from your county tax assessor or recent sales of vacant land in your area.

Method 3). The Income Approach

The Income Approach is typically used for rental properties and commercial real estate. It determines the value based on the income the property can generate.

Step 1 – Estimate Potential Gross Income

First, estimate the potential gross income of the property. For rental properties, this would be the total rent you could collect if the property were fully leased.

Step 2 – Estimate Effective Gross Income

Next, subtract vacancies and collection losses from the potential gross income to get the effective gross income.

Step 3 – Estimate Capitalization Rate

Then, estimate the capitalization rate, which is the rate of return a sound real estate investment should yield. You can consult real estate professionals or use online tools to calculate this rate.

Step 4 – Apply Capitalization Rate to Net Income

Finally, divide the net operating income by the capitalization rate. This will give you the estimated value of the property.

Method 4 – Gross Rent and Gross Multipliers Approach

This method is another way to value rental properties.

Gross Rent Multiplier

Step 1 – Divide Sales Price of Comparable Properties by Gross Monthly Rent

First, find the gross rent multiplier (GRM) by dividing the sales price of comparable properties by their gross monthly rent.

Step 2 – Apply Multiplier to Fair Market Rent of the Subject Property

Apply the GRM to the fair market rent of your property to estimate its value.

Gross Income Multiplier

Step 1 – Divide Sales Price of Comparable by Gross Annual Income

First, calculate the gross income multiplier (GIM) by dividing the sales price of comparable properties by their gross annual income.

Step 2 – Apply Multiplier to Gross Annual Income of Subject Property

Apply the GIM to the gross annual income of your property to estimate its value.

What is a Comparative Market Analysis?

A Comparative Market Analysis (CMA) is an invaluable tool used by real estate professionals to determine the market value of a specific property. This analysis, often regarded as a home value estimator, examines similar properties that have recently sold in the same area to provide an estimated value for a home.

The CMA process involves comparing the subject property to a set of at least three similar properties, or “comparables,” that have recently been sold in the same neighborhood. Factors considered in the comparison include the size of the property, number of bedrooms and bathrooms, location, and any unique features that may affect the home’s value such as renovations or curb appeal.

By understanding the price at which comparable properties have sold, homeowners and prospective buyers can gain insight into the home’s market value. This information is particularly useful for sellers in setting a competitive listing price, and for buyers, it can guide the down payment and offer they might put forward.

Moreover, a well-executed CMA can help both buyers and sellers save money. Sellers can avoid overpricing their homes, which can lead to longer listing periods and lower final sale prices. On the other hand, buyers can avoid overpaying for a property.

CMAs are also useful for mortgage lenders, who use them to assess the value of a home before approving a loan amount. It’s important to note that while CMAs provide a professional estimate of a home’s market value, they do not replace a formal appraisal.

In a fluctuating housing market, staying informed about local home prices and market trends is crucial. A Comparative Market Analysis offers valuable insights into the current state of the market, helping homeowners, buyers, and mortgage lenders make informed decisions.

Contact Joe. Join Our Newsletter.

Stay informed about the latest trends and tips in real estate by joining our newsletter.

There are several ways to determine the value of a house.

Whether you’re a homeowner looking to sell or an interested buyer, understanding these methods can help you make informed decisions in the real estate market.

Always remember, a professional appraisal may cost a few hundred dollars but it provides the most accurate value for your home. However, online home value calculators can provide a useful starting point for your estimates.