REAL ESTATE AGENT / DEFINITIONS Distressed properties often come up as a topic of interest. But what...

Blog

REAL ESTATE AGENT / DEFINITIONS Real Examples for 2024 By: Joe Stephenson REALTOR® Table of Contents Definition...

REAL ESTATE AGENT / DEFINITIONS Definition And Tips For Homeowners By: Joe Stephenson REALTOR® Table of Contents...

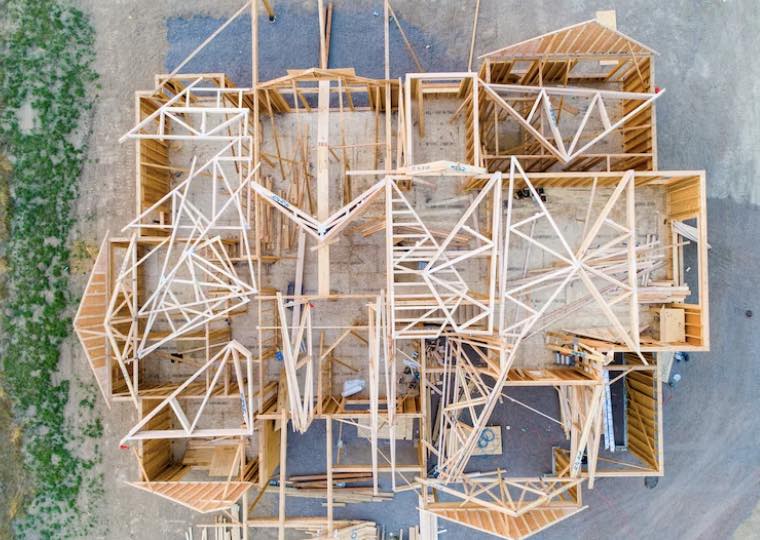

This guide aims to clarify the entire process, from securing financing to the final walkthrough. Table of...

REAL ESTATE AGENT / TINY HOUSES These tiny houses are for sale on Amazon. Click the links...

Moving is a big part of what I see every day as a real estate agent here...

Are you in the market for a new home? If so, you’ll want to check out the...

Fall-Winter of 2024 Joe Stephenson Real Estate Agent with 20+ years of experience Frequent laptop user and...

Kansas City, straddling the state lines of Kansas and Missouri, is an appealing location for real estate...

The self-storage industry has been a hidden gem in the realm of real estate investments. With its...