I love tracking numbers. This easy-to-use lease accounting excel spreadsheet template simplifies lease accounting for agents, property managers, and others in the real estate industry, providing clarity and structure. Having the right tools to track compliance with new lease accounting standards like ASC 842 is crucial, especially when working with complex agreements, multiple properties, or an entire lease portfolio.

Download the Free Excel + Google Sheets Template

No signup required. Instantly usable and ASC 842-compliant.

Who Is This Lease Accounting Template For?

- Real estate investors managing a lease portfolio who need to track liabilities.

- Property managers needing to ensure ASC 842 compliance for their clients.

- Accountants working with commercial and residential lease data without expensive lease accounting software.

- Real estate developers tracking lease liabilities across their projects.

There are some big changes in lease accounting, and it’s really important that people pay attention because so many are being caught off guard… it applies to how your leases are accounted for in your financial statements. They are now considered a debt.

Search in video 0:01 hi I’m Briana I’m an intern here at 0:03 Florida investment real estate and I’m a 0:05 junior at the University of Tampa and 0:08 today we’ll be talking to another one of 0:10 our fellow agents Miss Joe Coulter hi 0:14 Briana how are you doing today good and 0:17 yourself good we started this series of 0:20 lease Lounge um when Briana came to us 0:23 as an intern and she had some of the 0:25 same questions that our clients had so 0:28 what is the question today well recently 0:32 I’ve been hearing a little bit of talk 0:33 around the office um about one of our 0:35 clients trying to renegotiate the terms 0:37 of their loan you were helping them and 0:41 you mentioned something about a change 0:44 in accounting regulations that applied 0:46 to them if you could elaborate more on 0:48 that for me oh absolutely there are some 0:50 big changes and it’s really important um 0:54 that people pay attention because so 0:56 many people are being caught off guard 0:58 on with this 1:00 and it applies to how your leases are 1:04 accounted for in your financial 1:07 statements they are now considered a 1:10 debt and need to be accounted for in 1:14 those financial 1:16 statements what does that 1:18 mean well that means when um a business 1:22 um goes to apply for a loan or 1:25 renegotiates their current loans um that 1:29 the bank or the financial institution is 1:31 going to need to see on their um 1:34 financial statements that um debt of the 1:38 lease liability they will also come into 1:41 play if they have investors or different 1:45 um silent Partners will want to see it 1:47 helps with the transparency of their 1:50 financial um security also if um any of 1:55 these businesses are um doing any 1:57 government contracts the government will 2:00 want to see their financial statements 2:02 and this now um your leases are now um 2:06 part of the regulations um required to 2:09 be um notated on your financial 2:12 statements who does that apply to well 2:15 it applies to both landlords and tenants 2:18 but mostly the tenants because it is um 2:21 a large liability that they are um 2:23 contractually obligated to pay 2:25 throughout the um terms of their 2:28 lease okay how’s it accounted for is it 2:32 like a 10year lease and like just take 2:35 10% of it or well there’s discounts um 2:38 that are applied and um it is they they 2:43 do a little bit of um work with the 2:46 present value of the debt um so it’s not 2:50 as easy as one would imagine and it 2:54 applies to those who have one location 2:58 or 500 locations 3:00 um if you’re a big um corporate or if 3:03 you are um a small um privately owned 3:08 Bakery um if you have a lease over a 3:12 year it needs to be notated on your 3:15 financial 3:16 documents is it going to be an 3:18 accountant or like a CPA that’s going to 3:21 handle this or well you know your 3:24 accountant probably could but it might 3:26 not be the best use of that resource we 3:29 we do this type of accounting for our 3:32 clients and it might be a little more 3:34 cost effective to um allow us to help um 3:40 those who need this um 3:43 calculated okay thank you very much that 3:46 cleared up a lot of the confusion I had 3:49 about what exactly 842 was well I’m 3:53 happy to help and we are very happy to 3:55 have you as part of our team thank you 3:57 Brianna thank you Jill

Included in the Real Estate-Focused Lease Accounting Excel Template

This template helps you calculate key metrics, such as lease amortization, and organize how operating leases are amortized. It aligns with key points from the Federal Accounting Standards Advisory Board (FASAB).

Key Sections of the Template:

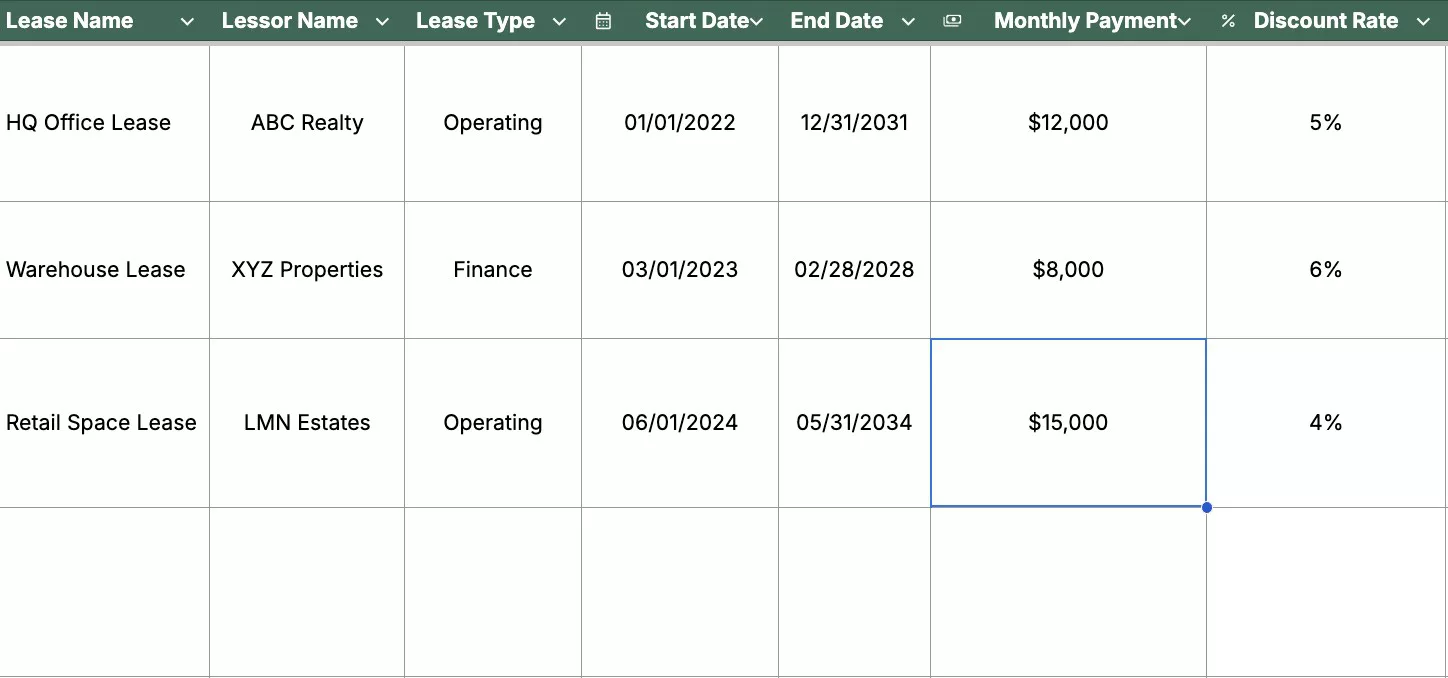

- General Information: Track Lease Name, Lessor, Lease Type, and Term for both operating and financial leases.

- Lease Payments: Document fixed monthly payments, prepaid lease payments, and any variable components.

- Right-of-Use (ROU) Asset: Calculate the initial ROU asset value and track accumulated amortization.

- Lease Liability: Monitor the initial lease liability, principal payments, and remaining balance.

- Discount Rate: Specify the rate used to calculate the net present value of lease payments.

- Disclosures: Detail future payment schedules, variable payment terms, lease incentives, and capitalization thresholds. For a deeper dive, a real estate chart of accounts template can be a helpful companion.

How to Customize the Template

While this template is ready to use, you can easily adapt it to your specific needs.

- Add Multiple Properties: Duplicate the main sheet for each property in your portfolio to keep records separate and clean.

- Change Amortization Periods: Adjust the formulas in the lease term and payment schedule sections to match your specific lease agreements, whether it’s for a short-term rental or a long-term commercial lease.

- Link to a Cash Flow Model: Integrate this sheet with a broader profit and loss statement to get a complete financial picture.

Important Terms to Familiarize With (FAQ)

It’s a table that tracks the reduction in the lease liability and right-of-use (ROU) asset over time, splitting each payment into principal and interest components.

This is an accounting method where the total cost of a lease is recognized evenly over the lease term, regardless of when payments are actually made. It smooths out the expense on your income statement.

These are incremental costs that are directly attributable to negotiating and arranging a lease, such as lease commissions or specific legal fees. These costs are included in the initial valuation of the ROU asset.

Joseph E. Stephenson, REALTOR®

License #00054082 | Kansas & Missouri

Affiliated with Welch & Company (License #CO00000477)

Joseph E. Stephenson is a licensed real estate professional in Kansas and Missouri with a career built on dedication to integrity and client-focused service. To learn more about how Joseph can assist you in your real estate endeavors, visit his REALTOR® profile at realtor.com.

Verify Joe’s Real Estate License Credentials

Real Estate Agent License VerificationVerify Joe’s Business Credentials

Joseph E. Stephenson also operates a business named Stephenson Residential, LLC. You can verify the business at the Kansas Secretary of State’s website.

Verify Business Credentials